Rivian stock has its best day ever after EV maker reports 2028. This incredible surge reflects investor excitement over Rivian’s ambitious production targets for 2028, a bold statement about their future in the rapidly evolving electric vehicle market. The announcement sparked a wave of positive sentiment, driving up stock prices significantly. But what exactly fueled this remarkable climb?

Let’s dive into the details behind Rivian’s ambitious plans and the market’s enthusiastic response.

This deep dive will explore Rivian’s 2028 production goals, comparing them to competitors and examining the challenges and opportunities ahead. We’ll look at the role of innovation, the impact of market forces, and even envision a hypothetical Rivian production facility in

2028. By the end, you’ll have a clearer understanding of what’s driving Rivian’s success and what the future might hold.

Rivian’s 2028 Vision: A Deep Dive into Production Targets and Market Outlook

Rivian’s stock experienced its best day ever following the announcement of its ambitious production targets for 2028. This surge reflects investor optimism about the company’s future growth potential. This article will delve into the details of Rivian’s 2028 projections, analyzing its production capacity, growth strategy, technological advancements, and the broader market factors influencing its stock performance.

Rivian’s Stock Surge: Understanding the 2028 Projection

Rivian’s announcement of its 2028 production targets holds significant weight, signaling the company’s confidence in its long-term growth trajectory and its ability to compete effectively in the burgeoning electric vehicle (EV) market. The market reacted positively, demonstrating a strong belief in Rivian’s potential to achieve these ambitious goals. This positive investor sentiment directly translated into a significant increase in Rivian’s stock price.

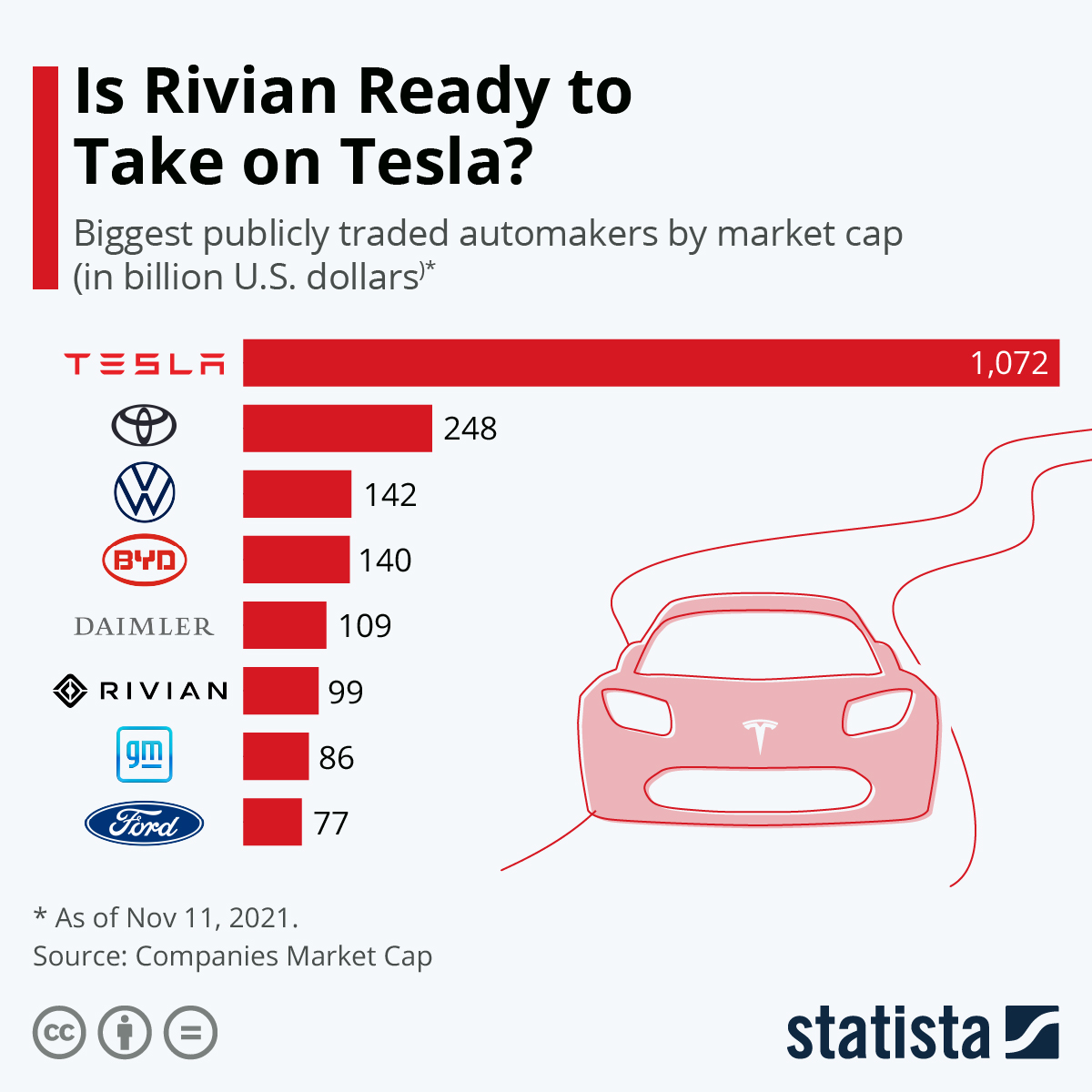

Comparing Rivian’s projections to its competitors provides valuable context. While specific projections from competitors may vary and be subject to change, the following table offers a general comparison based on publicly available information and analyst estimates:

| Company | 2028 Projection (Units) | Current Market Cap (USD Billion) | Key Strengths |

|---|---|---|---|

| Rivian | 1,000,000+ (estimated) | (Variable, check current market data) | Innovative technology, strong brand recognition, potential for diverse product offerings |

| Tesla | 2,000,000+ (estimated) | (Variable, check current market data) | Established brand, extensive Supercharger network, vertical integration |

| Ford | 500,000+ (estimated) | (Variable, check current market data) | Strong existing infrastructure, diversified product portfolio, established customer base |

| GM | 1,000,000+ (estimated) | (Variable, check current market data) | Extensive dealer network, diverse vehicle lineup, strong brand loyalty |

Note: These figures are estimates based on publicly available information and analyst predictions and are subject to change.

Rivian’s stock soared, hitting an all-time high after their impressive 2028 projections. It’s a stark contrast to the nail-biting tension of a different kind of competition; check out the detailed analysis of the Milan vs Juventus match from January 3rd, 2025, on ESPN: Milan 2-1 Juventus (Jan 3, 2025) Game Analysis – ESPN. Then, get back to celebrating Rivian’s success – it’s a good day for investors!

Analyzing Rivian’s Production Capacity and Growth Strategy

Rivian’s plan to reach its 2028 goals involves a significant increase in production capacity. This will likely entail expanding its existing manufacturing facilities, potentially building new ones, and optimizing its production processes. However, scaling production to meet such ambitious targets presents considerable challenges.

Potential challenges include securing sufficient supply chain resources (batteries, chips, etc.), managing workforce expansion, ensuring consistent product quality, and navigating potential regulatory hurdles. Rivian’s long-term strategy for maintaining market share and profitability beyond 2028 encompasses several key elements:

- Continuous innovation in vehicle design and technology.

- Expansion into new vehicle segments (e.g., SUVs, commercial vehicles).

- Strategic partnerships and collaborations to leverage external expertise and resources.

- Focus on sustainable manufacturing practices and supply chain resilience.

- Development of a robust charging infrastructure to support widespread EV adoption.

The Role of Innovation and Technology in Rivian’s Future, Rivian stock has its best day ever after EV maker reports 2028

Technological advancements are paramount to Rivian’s success. Key areas include battery technology (higher energy density, faster charging), autonomous driving capabilities, and advanced software features. Rivian’s significant investments in research and development are expected to yield substantial improvements in vehicle performance, efficiency, and manufacturing processes.

Rivian stock soared, hitting its all-time high after the EV maker announced ambitious 2028 production targets. This positive news comes as the US political landscape shifts, with États-Unis : Mike Johnson réélu à la présidence de la Chambre des Representatives, potentially influencing future legislation on electric vehicle incentives. Ultimately, Rivian’s success will depend on factors beyond just its production goals, including the overall political and economic climate.

A breakthrough in battery technology, such as the development of solid-state batteries, could significantly impact Rivian’s 2028 projections. For instance, increased energy density could lead to extended driving ranges, boosting consumer appeal and potentially exceeding initial production targets. Conversely, higher production costs associated with new battery technologies could temporarily impact profitability.

Market Factors Influencing Rivian’s Stock Performance

Macroeconomic factors, such as interest rates, inflation, and overall economic growth, significantly influence investor confidence in the stock market, including Rivian’s. The current market conditions for EVs differ substantially from those prevalent during Rivian’s initial public offering (IPO). Increased competition, evolving consumer preferences, and government regulations are key considerations.

| Factor | Impact on Rivian | Positive/Negative | Mitigation Strategy |

|---|---|---|---|

| Increased Competition | Pressure on pricing and market share | Negative | Product differentiation, technological innovation, strong brand building |

| Evolving Consumer Preferences | Shifting demand for specific vehicle features and types | Potentially Negative/Positive | Market research, agile product development, adaptability |

| Government Regulations (e.g., EV subsidies, emissions standards) | Opportunities and challenges related to compliance and incentives | Potentially Positive/Negative | Proactive regulatory engagement, compliance planning |

| Economic Downturn | Reduced consumer spending on discretionary items like EVs | Negative | Cost optimization, focus on efficiency, strategic partnerships |

Illustrative Example: A Hypothetical Rivian Production Facility in 2028

Imagine a sprawling, state-of-the-art Rivian production facility in 2028. The facility, encompassing millions of square feet, is a testament to sustainable manufacturing. Automated guided vehicles (AGVs) silently navigate the expansive floor, transporting components between stations. Robots perform precise welding and assembly tasks, ensuring high-quality production with minimal human intervention. Solar panels blanket the roof, providing clean energy, while rainwater harvesting systems support the facility’s water needs.

The architecture is modern and minimalist, emphasizing clean lines and natural light. The overall atmosphere is one of efficiency, innovation, and a commitment to environmental responsibility. The workforce, highly skilled and technologically adept, operates in a collaborative and empowering environment, leveraging advanced digital tools and data analytics to optimize every aspect of the production process. The facility’s size and complexity reflect Rivian’s commitment to scaling its production capabilities to meet the demands of the rapidly growing EV market.

Last Word: Rivian Stock Has Its Best Day Ever After EV Maker Reports 2028

Rivian’s impressive 2028 projections have sent shockwaves through the EV market, resulting in a record-breaking day for its stock. While challenges remain in scaling production and navigating market fluctuations, the company’s ambitious vision, coupled with its focus on innovation, positions it for significant growth. The market’s positive response underscores investor confidence in Rivian’s long-term potential, making this a pivotal moment in the company’s journey.

The coming years will be crucial in seeing how Rivian translates its ambitious goals into tangible results.

Questions Often Asked

What are the main risks associated with investing in Rivian stock?

Investing in Rivian, like any stock, carries inherent risks. These include competition in the EV market, production challenges, economic downturns, and regulatory changes. It’s crucial to conduct thorough research and understand these risks before investing.

How does Rivian’s 2028 projection compare to Tesla’s?

A direct comparison requires detailed data not provided in the Artikel. However, analysts and financial news sources often provide such comparisons, which you can easily find online.

Where can I find more information about Rivian’s financial performance?

Rivian stock soared today, hitting an all-time high after their impressive 2028 projections. It’s a big win for investors, but hey, sometimes you need a break from the market! Need a distraction? Check out the exciting game between Virginia Tech and Minnesota: Tune In: Virginia Tech vs. Minnesota. Then, get back to analyzing those Rivian numbers – they’re looking pretty good right now!

Rivian’s investor relations section on their website and reputable financial news sources will provide detailed financial information, including quarterly and annual reports.